Al Baraka Group B.S.C ("ABG" / the “Group”), licensed as an Investment Business Firm – Category 1 (Islamic Principles) by the Central Bank of Bahrain. It is a leading international Islamic financial group providing financial services through its banking subsidiaries in 13 countries offering retail, corporate, treasury and investment banking services, strictly in accordance with the principles of Islamic Shari'a. The Group has a wide geographical presence with operations in Jordan, Egypt, Tunisia, Bahrain, Sudan, Turkey, South Africa, Algeria, Pakistan, Lebanon and Syria, in addition to two branches in Iraq and a representative office in Libya and provides its services in more than 600 branches. ABG’s network serves a population totaling around one billion customers.

Home/Our Journey

1978

1978: Jordan Islamic Bank

Jordan Islamic Bank was the first Islamic bank in Jordan and was established in 1978 to carry on all types of financing, banking and investment activities in compliance with the provisions of the glorious Islamic Shari'a. The bank offers its banking, investment and financing services through its 105 branches.

1980

1980: Al Baraka Bank Egypt

Al Baraka Bank Egypt was established in 1980, it commenced its activities in accordance with Shari'a principles over many years and has grown as an Islamic institution to become one of the foremost in the Egyptian market. It provides a variety of services, products and savings deposit options to suit different requirements and financing programmes to meet the requirements of various sectors of the Egyptian market, in addition to credit facilities for companies and joint financings for large and important national projects. The bank currently has 32 branches.

1983

1983: Al Baraka Bank Tunisia

Al Baraka Bank Tunisia was established in 1983. The bank has both offshore and local retail activities in accordance to Shari'a principles. The bank operates 37 branches across Tunisia.

1984

1984:Al Baraka Bank Sudan

Al Baraka Bank Sudan was established in 1984 and its activities comprise retail, corporate, commercial and investment banking. The bank operates 28 branches.

1985

1985:Al Baraka Turk Participation Bank

Al Baraka Turk Participation Bank was established in 1985 and started operations in the same year. Al Baraka Turk currently renders its services through its 230 branches including 2 branch in Iraq.

1989

1989:Al Baraka Bank Limited

Al Baraka Bank Limited was established in 1989 and operates as a commercial Islamic bank, with a total of 11 branches.

1991

1991:Banque Al Baraka D'Algerie

Banque Al Baraka D'Algerie was incorporated in May 1991 as the first Islamic Bank and operates under a commercial banking license issued by the Bank of Algeria. The main activities of the bank are retail and commercial banking. The Bank operates 31 branches.

2002

2002:Al Baraka Banking Group

Al Baraka Banking Group B.S.C. ("ABG") is licensed as an Islamic wholesale bank by the Central Bank of Bahrain and is listed on NasdaqDubai. It is a leading international Islamic banking group providing its unique services in countries with a population totaling around one billion.

The Group has a wide geographical presence in the form of subsidiary banking units and representative offices in 17 countries, which in turn provide their services through over 700 branches.

2007

2007:Itqan Capital

Itqan Capital is a Saudi Arabia based investment company licensed by the Capital Market Authority, engaged in asset and portfolio management, principal investment, debt and equity arrangement, Itqan Capital aspires to be the Kingdom's pre-eminent provider of investment offering to pension funds, foundations, charities, endowments, private and public companies, high net worth individuals and family offices.

2008

2008:Al Baraka Banking Group Representative office, Indonesia

Indonesia's economic growth rate in 2015 is estimated at 4.7%, down a little from 5.0% in 2014. The current account deficit was once more reduced, to -2.0% from -3.1% of GDP, while the budget deficit remained little changed at -2.0% of GDP. The rate of inflation rose to 6.2% from 4.8% the year before.

2009

2009: Al Baraka Bank Syria

Al Baraka Bank Syria started its operations in accordance with Shari'a principles during 2009 and has grown as an Islamic institution offering a variety of financing products and services that suit different market segments and address their financial needs, via a chain of 13 branches spread across the major cities in Syria.

2010

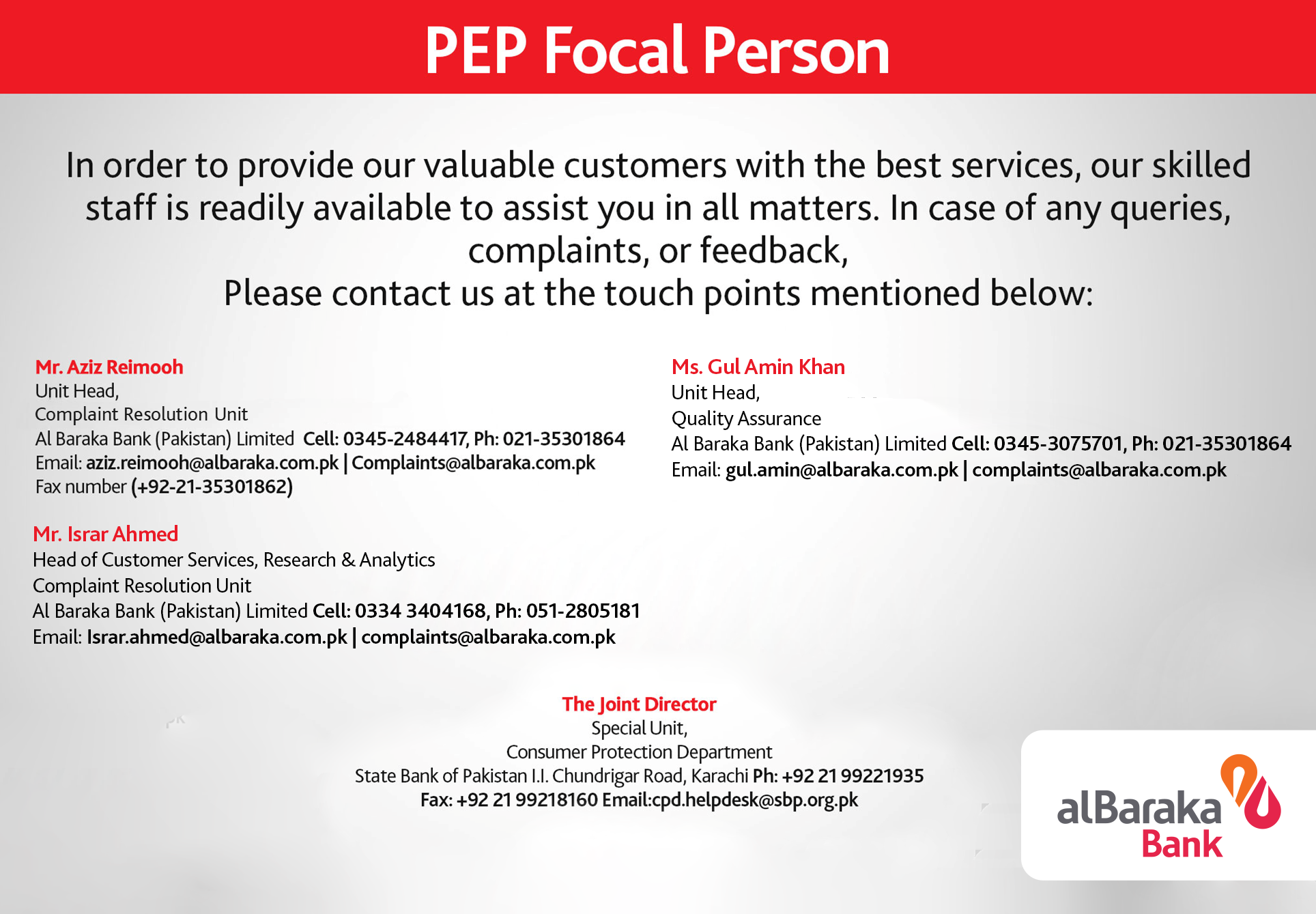

2010: Al Baraka Bank (Pakistan) Limited

Al Baraka Bank (Pakistan) Limited (ABPL) is the result of a merger between Al Baraka Islamic Bank Pakistan (AIBP) (the branch operations of Al Baraka Islamic Bank (AIB) Bahrain since 1993) and Emirates Global Islamic Bank (Pakistan). The merged entity commenced operations on October 30th 2010.

2011

2011:Al Baraka Banking Group Representative Office, Libya

ABG opened its new representative office in Tripoli in early 2011, in order to place the Group advantageously in the promising Libyan banking market to await the return to relative normality. The representative office supports and liaises with ABG units to establish and maintain relationships with local regulators and banks and explore appropriate opportunities for business when appropriate. Among all countries in Africa Libya has the largest certified oil reserve in the continent and among the planets suppliers of light sweet crude.

2011

2011:Sub unit of Al Baraka Turk

Iraq Branch, Al Baraka Banking Group has a branch in Iraq that is a sub-unit of Al Baraka Turk Participation Bank, was established in 1985 and started operations in the same year. Al Baraka Turk currently renders its services through its 213 branches.

2017

2017: Bti Bank

Website: https://btibank.ma/bti-bank/

2018

2018: Insha - Digital Banking Service

Website: https://www.getinsha.com/en

2022

2022: Al Baraka Group B.S.C (c)

Al Baraka Group B.S.C (c) ("ABG" / the “Group”), licensed as an Investment Business Firm – Category 1 (Islamic Principles) by the Central Bank of Bahrain. It is a leading international Islamic financial group providing financial services through its banking subsidiaries in 16 countries offering retail, corporate, treasury and investment banking services, strictly in accordance with the principles of Islamic Shari'a.