The rating reflects ABPL’s association with a strong Middle Eastern banking group, AlBaraka Banking Group, that lends significant support to the local subsidiary of the group. The sponsor’s commitment is demonstrated in recently agreed capitalization plan that should ensure timely compliance with minimum capital requirements. On a standalone basis, ABPL, while benefiting from recovery efforts, managed to limit fresh infection in the financing portfolio. It has attained pre-provision profitability, which is easing out pressure on its overall performance. However, continuity of the same remains important. The management is continuously making efforts to overcome its constraints including relatively limited branch network, high cost structure, and lower spreads. Success on planned initiatives is yet to be seen.

The Proposed Sukuk: To maintain adequate cushion in capital adequacy vis-a-vis planned growth in financings, ABPL is planning to issue unsecured, subordinated and privately placed sukuk of PKR 2,500mln (including PKR 500mln green shoe option) shortly. The tenor of the instrument would be of seven years ending in 2021. The sukuk holders, under the Islamic principle of Mudharaba, would be part of the Income Pool. The profit or loss, generated by the pool, would be distributed between the sukuk holders and other members of the pool as per the pre-defined parameters. The expected profit, to be calculated on the monthly weighted outstanding balance of the sukuk, would be based on floating rate.The principal repayment, starting after six months of the drawdown date, would be made semi-annually on a straight line basis. ABPL would carry the right to redeem the sukuk prior to maturity, subject to SBP’s approval.

The proposed issue carries a lock-in clause that stops principal and profit payments on the sukuk by SBP if ABPL falls below the Minimum Capital Requirement or Capital Adequacy Ratio. The sukuk is also subject to loss absorbency. If ABPL is determined at the Point of NonViability by SBP, the outstanding sukuk will be converted into ordinary shares. Given planned injections from sponsors and the ABPL’s profitability and capital projections, ABPL is expected to remain compliant with MCR and CAR covenants.

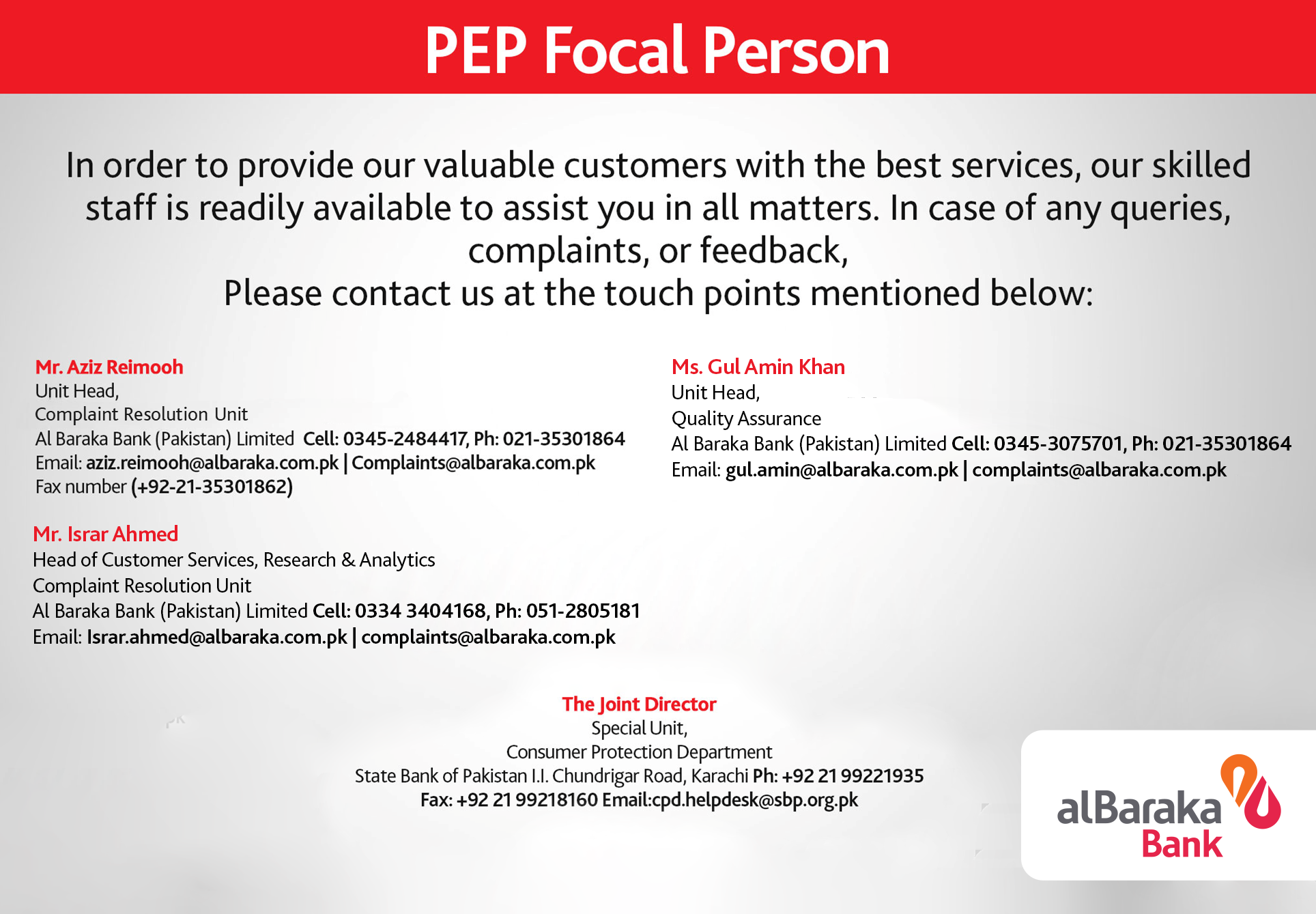

The Bank: AlBaraka Bank (Pakistan) Limited, commencing its branch operations in 1991, is currently operating with a network of 110 branches. AlBaraka Islamic Bank B.S.C., the majority shareholder (65%) in ABPL, is a majority owned (91%) subsidiary of AlBaraka Banking Group (ABG). ABG, incorporated in the Kingdom of Bahrain and a part of Dallah AlBaraka Group (DBG), is one of the largest Islamic banking and financial services institution in the world."