Treasury

We at Al Baraka Bank (Pakistan) Limited provide an attractive range of diversified investment options backed by high expertise and experience staff. We have one of the most competitive Islamic Treasuries in Pakistan, providing clients with a wide selection of products.

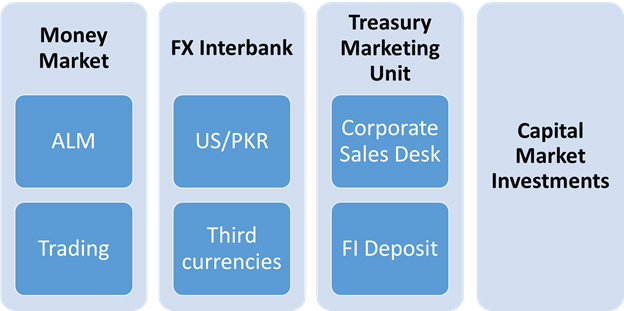

ABPL Treasury Comprises following desk:

We realizes the need for management of funds in an efficient manner, and that of engaging customers through its fine pricing and wide array of products. To this end, the Treasury provides comprehensive solutions to cater to both, with its dedicated salesmanship, prudent trading and funds management all blended well to ensure Shariah compliance.

Treasury is primarily responsible for managing the bank’s funded and nonfunded book. The ALM desk is very active, trading local currency as well as foreign currency Sukuk, executing placements and deposit transactions in the market through various Islamic mode.

ABPL is an active player in the interbank market and provides competitive prices in all major currencies. It is an institution of choice amongst importers and exporters, by providing superior treasury products to its clients and assisting them in covering their currency exposures and risks. Our dynamic corporate sales and trading teams provide up-to-date market intelligence, advice and timely execution of deals to our customers throughout the trading day. Whether the transaction is Local Currency (USD/PKR) based or Global Currency.

ABPL Treasury is also very active in managing Financial Institutions Deposit in Al Baraka Islamic Institutions Deposit Category (AIIDA) which provides attractive market rates especially designed for Asset Management Companies and their funds under management, Modaraba, Takaful companies and other Islamic financial institutions.

We provide market rate views and analysis to our entire client base on a regular basis to enable them make informed and calculated investment decisions.

Financial Institutions Group:

Albaraka Bank Pakistan has maintained bank’s long-standing correspondent banking relationship with over 300 international banks worldwide. This global banking partnership has been managed by the Financial Institutions Department (FID), an essential department of the Treasury Group.

Its mandate is to open, develop, manage and monitor all Nostro/Vostro account arrangements and reciprocity; compile and disseminate L/C exchange information, coordinate with Al Baraka Group B.S.C ("ABG" / the “Group”) overseas units:

Algeria – Bahrain – Egypt – Indonesia – Iraq – Jordan – Lebanon – Libya – Pakistan – Saudi Arabia – South Africa – Tunisia – Turkey –Morocco ; attend to all international operations issues addressed by correspondent banks, domestic divisions and customers; develop a comprehensive global country limit review procedure and establish country limits; recommend appropriate credit limits for banks in addition to the following:

- • Managing a network of correspondents providing services for outward business generated by the domestic customers of ABPL. It seeks to provide the highest quality service at the best price.

- • Provides project-related Shariah Complaint guarantees in favor of Pakistan based beneficiaries in coordination with partner banks and bond applicants.

- • Advising and confirming Letters of Credit in favor of Pakistani exporters on behalf of foreign banks.

Ensuring considerate compliance of KYC/AML for all relationships.